trust capital gains tax rate 2019

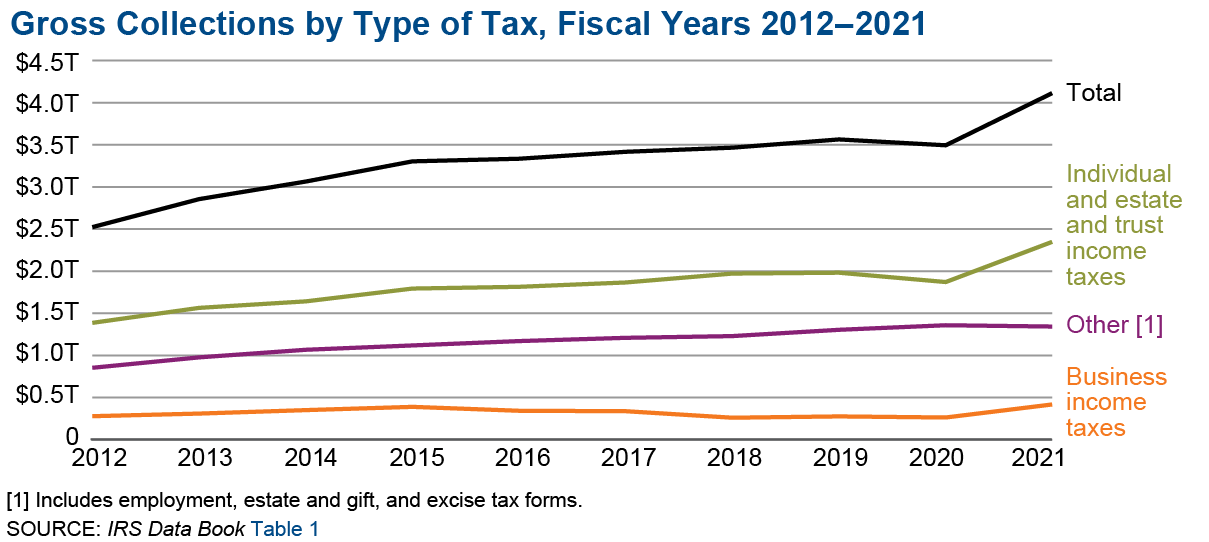

Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. Law info - all about law.

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

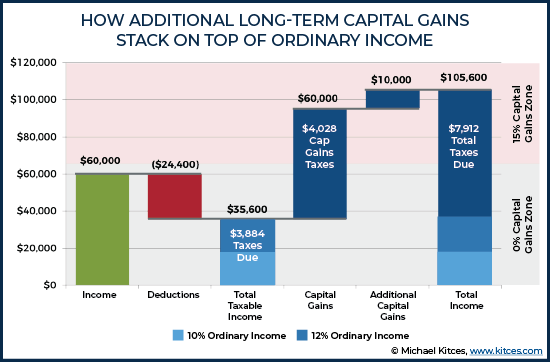

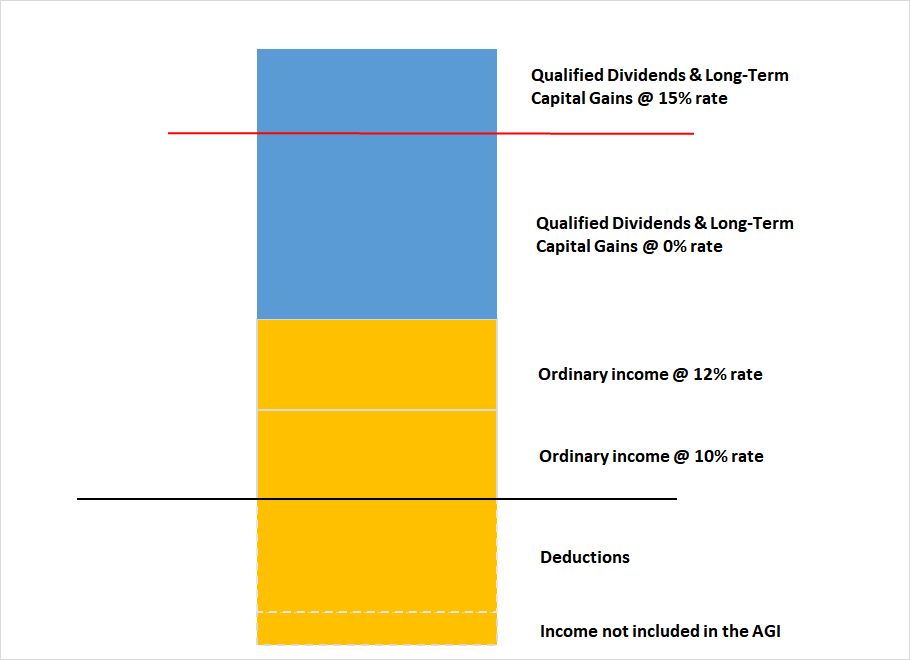

. This gap in income tax treatment has widened considerably under the TCJA. A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends. The biggest difference between the two sets of tax brackets is that income tax has a much higher top tax rate than the top tax rate for capital gains and dividends.

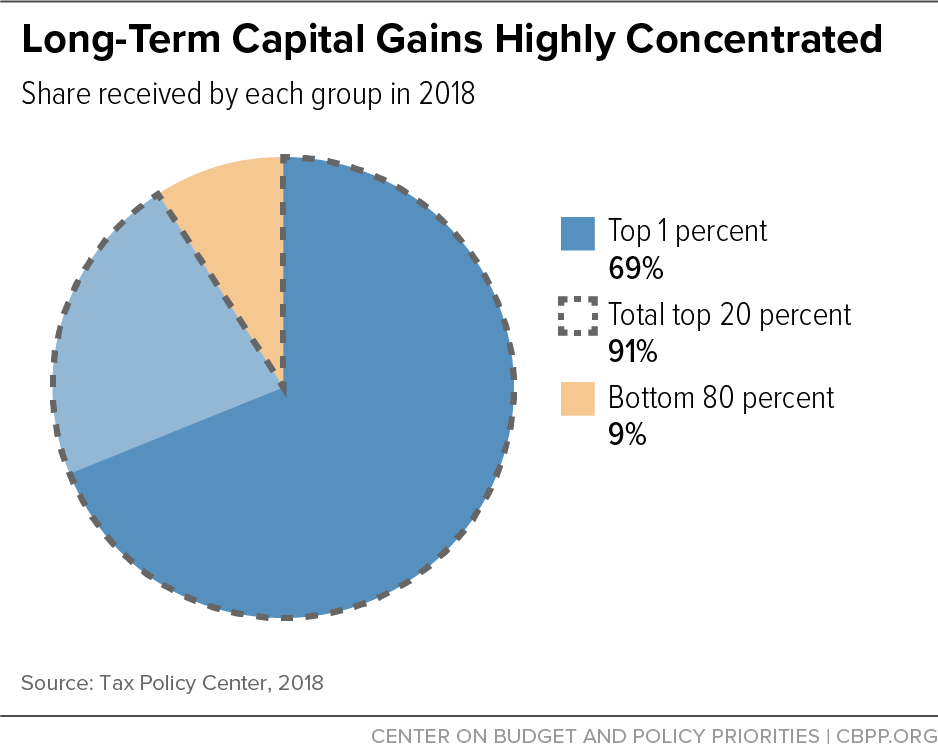

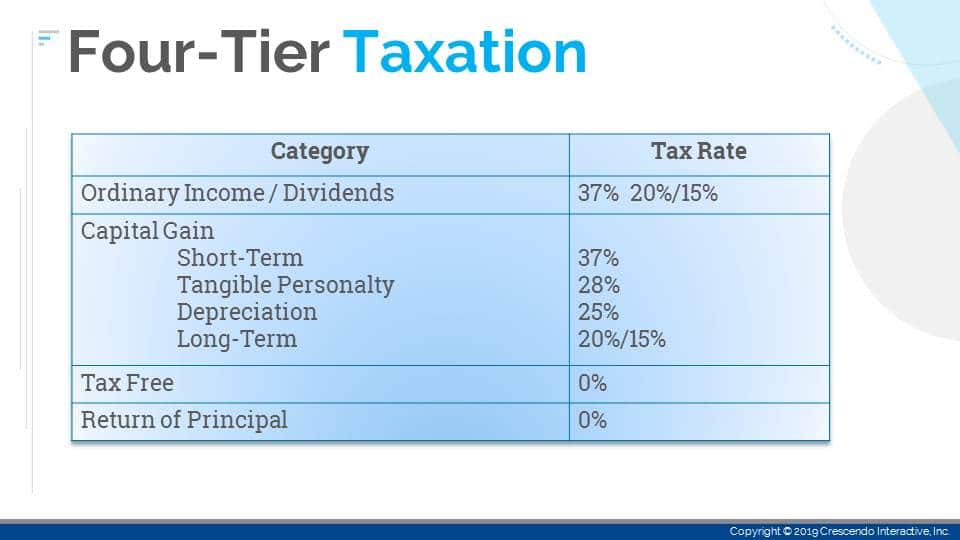

Capital Gain Tax Rates. The maximum tax rate for long-term capital gains and qualified dividends is 20. Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance.

Many people who create a revocable living trust place their homes in the trust. Some or all net capital gain may be taxed at 0 if your taxable income is. The tax rate on most net capital gain is no higher than 15 for most individuals.

For tax year 2019 the 20 rate applies to. For example a single individual with 172925 of interest income and no deductions will pay. Guidance about the tax-free allowance and telling HMRC about capital gains made by a trust has been updated.

A trust may only have up to 2650 in 2019 of taxable income and still be taxed at 0 on its capital gains and qualified dividends. By doing this you do not give up your right to claim a capital gains tax exclusion when. For tax year 2019 the 20 rate applies to amounts above 12950.

HS294 Trusts and Capital Gains Tax 2019 This helpsheet explains how UK resident trusts are treated for Capital Gains Tax. 2018 to 2019 2017 to 2018. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

The new tax rates for year 2019 announced There is slight increase in the Estate Tax Exclusion amount in this year. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits. So a decedent dying between Jan.

For tax year 2019 the 20 rate applies to amounts above 12950. 2022 Long-Term Capital Gains Trust Tax Rates. 18 and 28 tax rates for individuals the tax rate you.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Capital gains tax rates on most assets held for a year or less correspond to. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

It also deals with situations where a person disposes of an. Find out more about. Capital Gain Tax Rates.

6 April 2019 Rates allowances and duties have been updated for. The tax-free allowance for trusts is. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The 2019 estimated tax.

The Tax Impact Of The Long Term Capital Gains Bump Zone

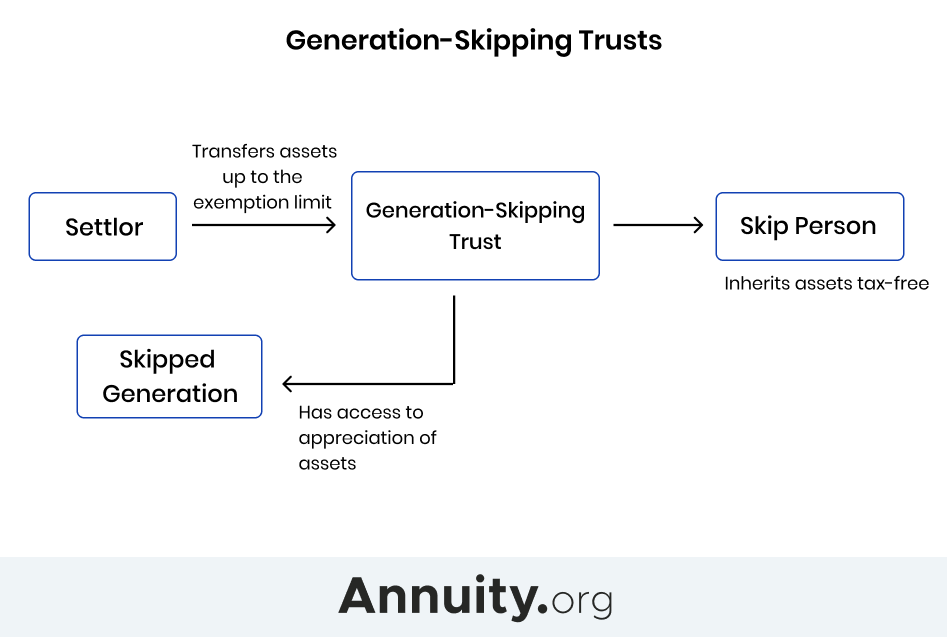

Generation Skipping Trust Gst What It Is And How It Works

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Soi Tax Stats Irs Data Book Internal Revenue Service

Delaware Trust Conference October 22 Ppt Download

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Great Time For A Grat Journal Of Accountancy

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Planned Giving Hays Medical Center Foundation

An Overview Of Capital Gains Taxes Tax Foundation

Texas Lowers 2019 Unemployment Insurance Tax Rate 501 C Agencies Trust

Estimated 2019 Tax Brackets And Exemption Amounts For Trusts And Estates Preservation Family Wealth Protection Planning

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Unexpected Tax Bills For Simple Trusts After Tax Reform

Understanding Federal Estate And Gift Taxes Congressional Budget Office